Our Survey

Sed posuere consectetur est at lobortis.

Sed posuere consectetur est at lobortis. Cras mattis consectetur purus sit amet fermentum. Lorem ipsum dolor sit amet, consectetur adipiscing elit.

REAL NEWS: In compliance with state and federal law, short-term lenders provide full disclosure of all terms and costs associated with loans they provide, including clear signage in all their stores outlining these terms and conditions and a written agreement the borrow must sign that explains these terms and conditions.

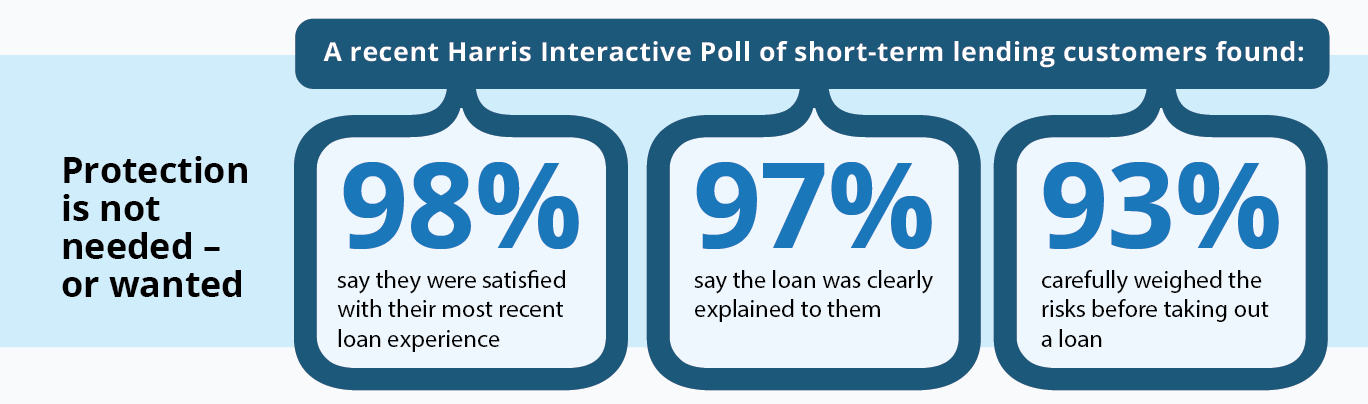

These customers continue to be satisfied with the service they receive at the credit-access institutions they use.

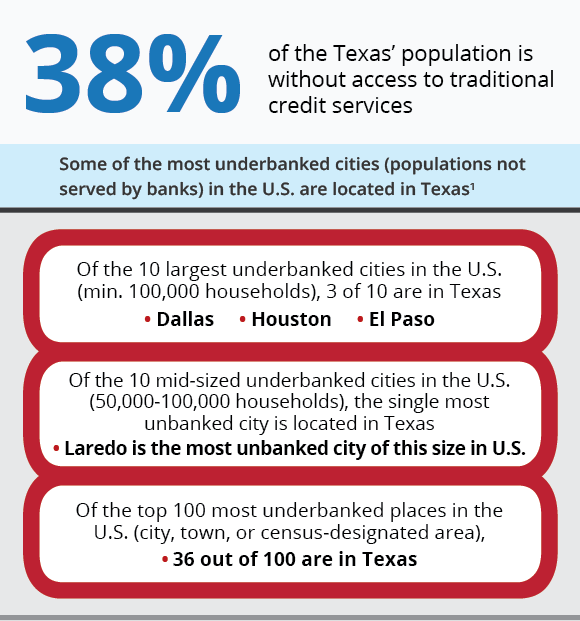

REAL NEWS: Restrictive local ordinances not only limit access to credit but they drive up the cost of loans for those who already have few credit options. In fact, these ordinances cause the price of loans to increase at the remaining short-term lenders because there are fewer places to obtain credit, resulting in less competition. Texas is one of the most underbanked states in the United States, where many people do not have access to more traditional credit options. These ordinances do nothing to stop need for credit by these individuals.

¹https://cfed.org/newsroom/experts/ethan_geiling/the_most_unbanked_places_in_america/

REAL NEWS:

APRs are annualized estimates of costs. A typical credit-access loan must be rolled over 26 times for it to reach an effective rate of 400 percent, but the average customer rolls over a loan only 1.25-1.4 times.

1,000% APR; credit card balance with late fee = 956% APR; utility bill with late and reconnect fees = 1,203% APR" />

1,000% APR; credit card balance with late fee = 956% APR; utility bill with late and reconnect fees = 1,203% APR" />

REAL NEWS: Information available from The Texas Office of Consumer Credit Commissioner noted that while storefront demand decreases in cities that pass the financial ordinance, people simply go online or to other communities to meet their financial needs.

REAL NEWS: There are more than 40 cities in Texas that have passed financial ordinances, yet not one violation was cited from 2011 - 2016. It wasn't until 2017 that the City of Austin cited two stores for violating its local financial ordinance. Both ordinance violations were dismissed by the Municipal Court because state law pre-empted the local ordinance rule. The County Court disagreed. These decisions are currently under appeal.

REAL NEWS: Less than 1% of all consumer financial complaints from the CFPB are related to the short-term lending industry. People clearly understand the terms and conditions of their loan and value access to these services.

Contrary to widespread belief, public financial data shows the average Starbucks makes more than six times the profits of the average short-term lender. Wells Fargo, Citibank, Goldman Sachs, and PNC have net profit margins above 24%. Comparatively, the top three publicly traded short-term lending companies have single digit returns on investment.

Sed posuere consectetur est at lobortis.

Sed posuere consectetur est at lobortis. Cras mattis consectetur purus sit amet fermentum. Lorem ipsum dolor sit amet, consectetur adipiscing elit.